Choosing the right forex trade brokers is a critical step for any trader. With countless options available, finding a broker that matches your trading style and preferences can feel daunting. This article outlines effective strategies you can use to compare forex brokers and make an informed decision.

Evaluate Trading Platforms

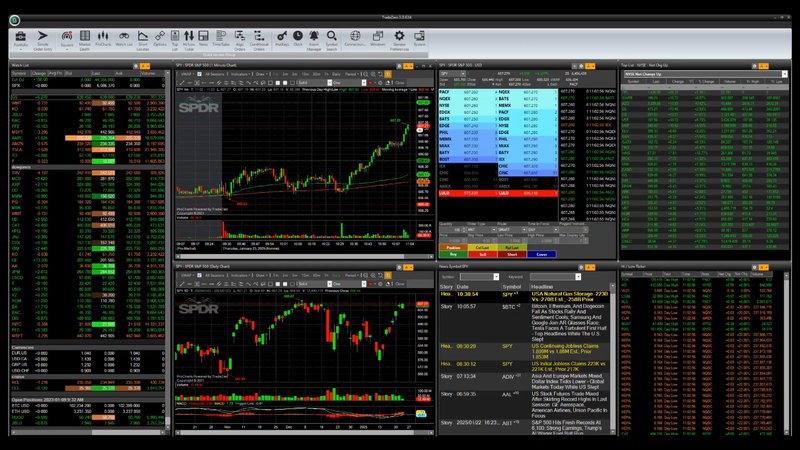

A broker’s trading platform is the foundation of your trading experience. Look for platforms that are user-friendly, stable, and equipped with the tools you need to analyze the market and execute trades efficiently. Features like advanced charting tools, customizable interfaces, and quick execution times can enhance your overall experience.

MetaTrader 4 (MT4) and MetaTrader 5 (MT5) remain popular choices. However, some brokers develop their proprietary platforms, offering features tailored to their client base. Take advantage of demo accounts to test the platform before making your decision.

Assess Available Currency Pairs

Different brokers offer different ranges of currency pairs. If you’re interested in trading more than just major forex pairs (like EUR/USD or GBP/USD), you’ll want to ensure the broker provides access to minor and exotic pairs. Compare the number and variety of currency pairs available to find a broker that fits your trading interests.

Understand Fees and Spreads

The cost of trading can significantly impact your profitability. Brokers typically make money through spreads (the difference between the bid and ask price) and/or commissions. Lower spreads can be advantageous for frequent traders, especially scalpers.

Some brokers operate on a zero-commission model, recouping costs through spreads, while others charge a flat commission per trade. Carefully compare these costs across brokers and calculate how they might affect your bottom line over time. Beware of hidden fees, such as account maintenance fees or withdrawal charges, which could add up over time.

Analyze Leverage Options

Many brokers offer flexible leverage, allowing traders to manage larger trading positions without significant upfront capital. The availability of appropriate leverage levels is an important factor, as it can directly affect your trading strategy. Make sure the leverage options align with your risk tolerance and trading expertise.

Examine Educational Resources and Tools

Forex trading can be complex, especially for beginners. The availability of educational resources is a factor worth considering when selecting a broker. Look for brokers that offer video tutorials, market analysis, webinars, or blogs to help build your knowledge base.

Additionally, having access to research tools, like economic calendars or sentiment trackers, can help you make more informed trading decisions as you grow as a trader.

Focus on Customer Support

Last but certainly not least, reliable customer service can make a significant difference in your trading experience. Opt for brokers that offer multiple support channels (live chat, phone, email) and operate in your preferred language. A broker with responsive and knowledgeable customer support ensures you have access to timely assistance when it matters most.

Final Thoughts

Comparing forex brokers effectively comes down to understanding what’s important to you as a trader. Evaluate factors like trading platforms, spreads, leverage, and educational resources to find the broker that best suits your needs. By following these strategies, you can approach your trading with confidence.